The views expressed are the views of Foundation Asset Management (HK) Limited only and are subject to change based on market and other conditions. The information provided does not constitute investment advice and it should not be relied on as such. All material has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. This material contains certain statements that may be deemed forward-looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Investors should note that investment involves risk.

The price of units may go down as well as up and past performance is not indicative of future results. Investors should read the explanatory memorandum for details and risk factors in particular those associated with investment in emerging markets. This commentary has not been reviewed by the Securities and Futures Commission.

This Is What I Call A Target-Rich Environment

7 June 2022

China markets

received a slew of encouraging news over the past week, with Premier

Li’s address signaling greater urgency to support the economy in an

impromptu meeting, Shanghai ending lockdowns, as well as incremental

loosening of fiscal and monetary policy. Earnings seasons broadly came

in better than expected, suggesting sentiment was too dire.

On

the contrary, significant hurdles remain with a likely miss on China’s

GDP growth target this year, quasi-state-owned property firm Greenland

asking for an extension for its bond repayment and uncertainties

regarding US ADRs delisting.

As Top Gun is back on the screens

after 36 years, the famous

quote by Maverick applies to China markets now more than ever. We see a

“target-rich environment” for both longs and shorts. With

the recent rally, we can now reload on structurally unprofitable shorts

that are already experiencing higher costs of capital in this regime. On

the long side, certain cyclicals and tech names are trading at trough

valuations, with consensus sentiment at rock bottom.

As Marvel

character Jessica Jones once said,

“Don’t try to be a hero.

It’s a s***ty job.” All signs from our top-down

‘quantamental’ and fundamental value investing process suggests it’s not

the time yet to be the hero i.e. sticking our head out of the sand (flip

to drastically net long) just to get shot down. There’s no need to

completely flip the switch anyway in this “target-rich environment”.

Below are some of our brief observations recently:

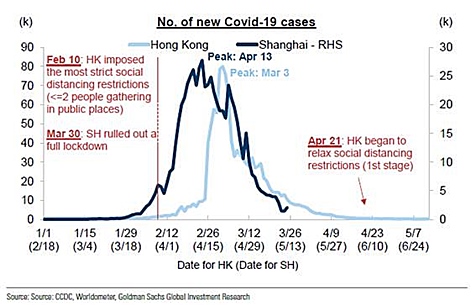

1. Hong Kong

as an example, expect gradual reopening

• Hong Kong has completed the

second stage of removing social distancing restrictions, third stage

expected in June or July

• Development of COVID-19 cases in Hong Kong

and Shanghai followed similar trends, with Shanghai reopening on June 1

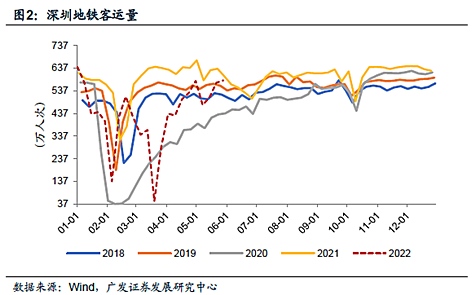

• Passenger volume of Shenzhen Metro has

already exceeded the number in 2018, 2019 and 2020 during the same

period

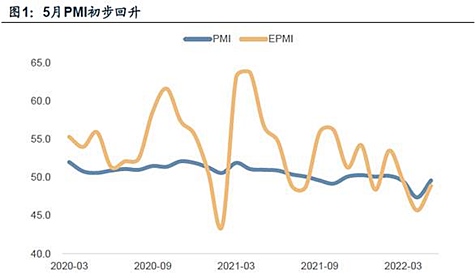

2. Sequential rebound of PMI in May

• China manufacturing PMI in May rose by 2.2% month-on-month to 49.6%, still below the expansion line

• Easing of cases allowed some regions to resume work and production, which has led to a significant rebound in the manufacturing activity. With the gradual recovery of the supply chain, export orders and inventory turnover levels have improved significantly.

• Indicators such as employment and employment expectations are still at low levels, indicating a tough labor market environment

• More stimulus is needed to cement the foundation of economic recovery

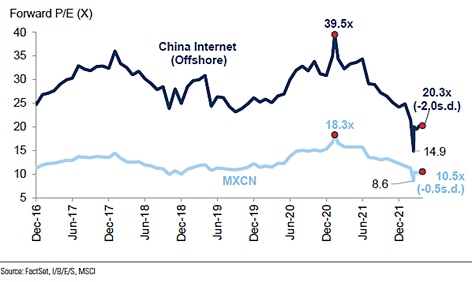

3. Sentiment pessimistic, internet earnings beat

• Most Chinese internet companies have already released their 2022 first quarter results

• E-commerce revenue and profits were better than expected, Alibaba +15%, JD +5%, Pinduoduo +15% after results

• Some of the earnings beat were from large-scale cost cuts, opportunities to re-short if we think this is unsustainable for certain companies

• Overall sector valuations are at -2 standard deviations below the mean and below 5% percentile