The views expressed are the views of Foundation Asset Management (HK) Limited only and are subject to change based on market and other conditions. The information provided does not constitute investment advice and it should not be relied on as such. All material has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. This material contains certain statements that may be deemed forward-looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Investors should note that investment involves risk.

The price of units may go down as well as up and past performance is not indicative of future results. Investors should read the explanatory memorandum for details and risk factors in particular those associated with investment in emerging markets. This commentary has not been reviewed by the Securities and Futures Commission.

A Tale of Two Policies in Two Geographies

17 June 2022

We are just half way through June and that means one thing for China investors – economic data period. CPI, Aggregate Financing to the Real Economy etc. came out last week, whilst other important data such as retail sales was published this week.

Below are some of our brief observations recently:

1. Divergence in policy, China from “headwinds” to “tailwinds”

• JP Morgan global head of macro quantitative and derivatives strategist pointed out that, “Credit growth, which has historically been a positive indicator for the stock market, is showing signs of strength in China.

"

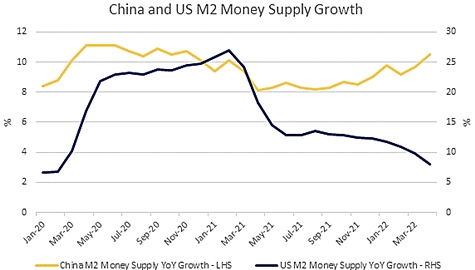

• Benefiting from PBOC’s support, China's M2 increased by 11.1% year-on-year in May, accelerating from April's 10.5%. Aggregate financing to the real economy (flow) in May was RMB 2,790 billion, beating expectations

• U.S. monetary policy tightened as M2 yoy growth slowed to 8% in April from 9.8% in March

2. China online retail sales bottoms out

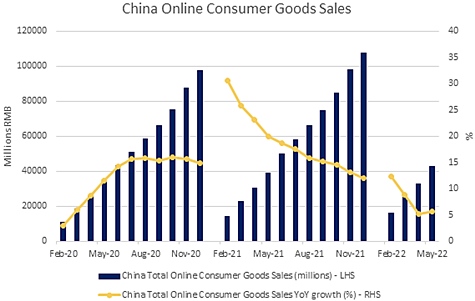

• China’s online consumer goods sales rose 5.6% in May, accelerating from April’s 5.2%

• Total retail sales (including offline) fell 6.7% yoy in May, narrowing from -11.1% in April

• As COVID cases are now contained, retail sales should continue to recover with catalysts such as the 6.18 shopping festival

3. Divergence in China and US indexes

• Chinese stocks underperformed US from the start of the year until mid-March. Since the rebound, MSCI China has now outperformed S&P500 by 7pp YTD

• Due to its low correlation and diversification benefits to other developed markets, Chinese equities should be treated as its own asset class and an important part of any global asset allocation

• China now has both fiscal and monetary support, whilst the US stock market is continually concerned over inflation, rate hikes and quantitative tightening